Contents:

It can also be used to view expenditures on specific projects or business ventures. A business can review this data to directly trace where the money is going within targeted report criteria. This is the main report to run to keep a finger on the pulse. It enables a business to effectively manage invoicing and keep up on due dates. An AP aging report will help to identify the vendor payments that are past their due dates and to prioritize AP actions.

- https://maximarkets.world/wp-content/uploads/2021/06/platform-maximarkets-4.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/forex_trader.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/ebook.jpg

- https://maximarkets.world/wp-content/uploads/2019/03/Platform-maximarkets-2.jpg

- https://maximarkets.world/wp-content/uploads/2021/06/platform-maximarkets-5.jpg

Hopefully it is added only to the “essentials ” version of quick books. Anyone who owns a business that offers terms to their clients requires a report showing the Average Days to Pay of a customer. Business owners share this type of information and cannot make an educated decision on the credit worthiness of a customer without this type of report. I’ll help you by sending your feedback to our management team. They will pass this along to our software engineers to be reviewed. Note that you can only export a report to excel one at a time.

Technical Details

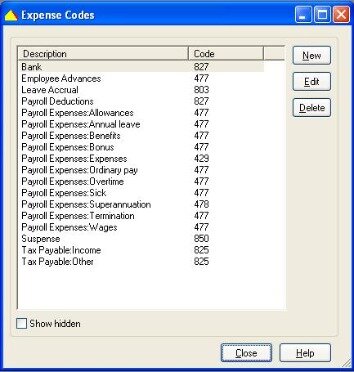

Here you will see all the custom reports in QuickBooks Online saved by users of your account. QuickBooks Online comes with three pricing plans, each with a varying set of features. However, because financial reporting is such an essential part of any business, there’s a wide range of reports available even on the lower Smart Start plan. This article is about the accounts payable and the bills and expenses differences. QuickBooks automatically records and tracks payments made to vendors via check or Direct Deposit, helping minimize error.

5 Best Accounts Payable Software for Small Businesses – The Motley Fool

5 Best Accounts Payable Software for Small Businesses.

Posted: Wed, 18 May 2022 07:00:00 GMT [source]

Only https://bookkeeping-reviews.com/es using the accrual basis of accounting, not cash-based accounting, are subject to accounts payable. Due to the accrual method of accounting, income and expenses are only recorded after they have been invoiced and paid. Instead of expecting immediate payment, accrual accounting uses invoice processing to both procure and offer services on a credit basis. You typically have 30 days to pay a bill after receiving an invoice from a vendor for a good or service.

Relax—run payroll in just 3 easy steps!

On the other hand, if your business is considered as taking advantage of discounts on early payments if it is paying its suppliers very quickly. You need to check the invoices thoroughly received from your suppliers. Examining invoices is essential to ensure the accuracy of data. The filters allow you to filter the aging report based on vendor and location. You will now see that the bill payment check will not be there which was the reason for creating the negative account payable in QuickBooks. It will help to know who to pay, how much, when, and any other conditions required to transact efficiently.

After you pay Vendor 3 the $100, make sure you change the 61 – 90 days column to say $0. Your report can help you see which payments are past due and determine which balances to pay off first. Even on the most basic QBO plan you have access to plenty of rich reports. First of all, decide on the report you’d like to use as a management report. You can use any of the existing reports but if you plan to make any adjustments to it, you will first need to save it as a custom report. While in there, you can also access other project reports in QuickBooks Online – Project profitability and Unbilled time and expenses.

In addition to choosing the aging method you did in item C in Step 2, you can also indicate the number of periods and days covered for every aging period. Once prompted, You need to save changes and select the No button. A bill payment check will be opened on your computer screen. She prides herself on reverse-engineering the logistics of successful content management strategies and implementing techniques that are centered around people . If you are ordering items in bulk, there may be an opportunity for a discount there as well. Business owners love Patriot’s award-winning payroll software.

How to customize reports in QuickBooks Online?

Then you need to locate the xero accounting software blog and news you have created in step 1. You can also refer to the original bill and try to enter the exact date and other details from the original bill to the new bill. Here you should enter a bill to the vendor which was being displayed on the previous screen.

An ineffective accounts payable management can lead to invoices not being processed on time. When Robert Johnson Pvt Ltd makes payment to its supplier, the accounts payable account gets debited. This is because Robert Johnson’s current liability reduces by $200,000. The offsetting credit entry for such a transaction is made to the cash account.

Under the Net Method, if you pay your supplier within the agreed-upon time period, you get a certain percentage of the discount. This is to promote moderate and favorable buying from your suppliers. These include the supplier’s performance, his financial soundness, brand identity, and his capacity to negotiate. Following are some of the strategies that you can adopt to optimize your business’s accounts payable. However, delaying payments for a long period would critically impact Walmart’s relationship with its suppliers.

A bill is money that your business owes but will pay at a later date. Increased insight of your business expenses optimizes spending efficiency. We provide you support through different channels (Email/Chat/Phone) for your issues, doubts, and queries. We are always available to resolve your issues related to Sales, Technical Queries/Issues, and ON boarding questions in real-time. You can even get the benefits of anytime availability of Premium support for all your issues. You can export a Chart of Accounts, Customers, Items, and all the available transactions from QuickBooks Desktop.

Verifying entries and comparing system reports to balances in order to reconcile processed work keeping historical records. Paying employees involves creating paychecks and verifying expense reports. It’s time to update your books to reflect the most current information after you’ve finished steps 1-4. Accounting software allows you to Automate the Reconciliation procedure. You can remove vendor payment from your list of accounts payable once the money has been received from them. Dancing Numbers is SaaS-based software that is easy to integrate with any QuickBooks account.

- https://maximarkets.world/wp-content/uploads/2019/03/Platform-maximarkets-1.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/logo-1.png

- https://maximarkets.world/wp-content/uploads/2019/03/MetaTrader4_maximarkets.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/forex_education.jpg

The bill for the fresh tomatoes was placed in your accounts payable as the restaurant owner. However, the vendor put that $100 invoice to their Accounts Receivable because it is money they plan to receiving. The accounts payable process contributes significantly to your company’s accounting operations in a number of ways. Check that the vendor whom you want to pay this bill is on your vendors list or not.

Method 1: Record Bill using the Enter Bills Window

We’ll now explain where to find the ones you’re interested in the most. We’ll also touch on how to export them with the method of your choice. Connect to your QuickBooks account and select the report you want to export. If you’re planning to work with your data and generate reports from your favorite spreadsheet tool, Coupler.io is a much better solution. Users of Google Sheets are also at a disadvantage as the process of importing .xlsx files into Drive is clunky and time-consuming. You can schedule exports, say every day or every hour, to Google Sheets or Excel and share this spreadsheet with your stakeholders.

However, this is only possible if you tagged the expense transaction as billable. Let’s run and customize the Purchases by Vendor Detail report. The reports you’ve mentioned are for the vendor’s account and therefore don’t have the customer fields. There are 2 Accounts Payable workflows available in QuickBooks Desktop. To record your Accounts Payable transactions, choose the workflow that best suits your business and follow the steps for creating each transaction.

That is, it indicates the number of times your business makes payments to its suppliers in a specific period of time. Thus, the accounts payable turnover ratio demonstrates your business’s efficiency in meeting its short-term debt obligations. So, whenever your supplier provides goods or services on credit to your business, there are accounts payable outstanding on your balance sheet. This means the accounts payable account gets credited as there is an increase in the current liability of your business.